14+ fha voe loan

Submit a loan inquiry. Re-verification of employment must be completed within 10 Days prior to the date of the Note.

What S Needed From Your Fha Loan Applications

Youll need a credit score of at least 680 in order to get the best deal and a 20 down payment.

. Ad FHA VA Conventional HARP And Jumbo Mortgages Available. It is a form that must be completed by the. Ad Has the value of your home gone up.

With a Low Down Payment Option You Could Buy Your Own Home. However the lender must verify the borrowers. Apply Easily And Get Pre Approved In 24hrs.

Program Highlights Wage-Earner are qualified using employers Written Verification. Name and Address of Applicant. Ad Compare Top FHA Mortgage Lenders 2022.

The answer is yes enter the Federal Housing Administration loan California FHA Loan. Department of Housing and Urban Development HUD provides guidance on the modifications to re. A verification of employment will be conducted for the employee and will include.

To apply for an alternative income verification loan also known as a VOE loan or VOE mortgage call us today. With the VOE loan program approval is much faster than through a conventional or FHA loan. Dream Maker Grant up to 5000 1 Unit.

When You Need It. If Approved Access Funds To Help You Grow Your Business. When You Need It.

Apply Today Save. In Mortgagee Letter 2020-05 dated March 27 2020 the US. See Todays Rate Get The Best Rate In A 90 Day Period.

Verbal or electronic re. Dont Waist Extra Money. We offer the lowest mortgage.

With a Low Down Payment Option You Could Buy Your Own Home. That document was issued in. The FHA loan cash out refinance is more available now than ever before.

Not all FHA loan applicants may be. Standard Loan with 620 score 1-4 Units. The best way to get a VOE loan in Florida is to work with a company that understands the ins and outs of how they work such as LBC Mortgage.

FHA loans in California are a type of mortgage that is insured by the Federal Housing. My signature below authorizes verification of this information. 580 Credit Score for 1-4 Units.

Generally easier to qualify for than conventional loans. No Down Payment with 620 score 1-4 units. Why Rent When You Could Own.

Conforms with FHA requirements at IIA1aiA1. A VOE loan is a mortgage loan that uses other financial information to satisfy loan requirements and can use social security income as well. To be eligible for a mortgage FHA does not require a minimum length of time that a borrower must have held a position of employment.

Ad Multiple banks with a single application. According to the rules printed in HUD 41551 the lender will require a current pay statement and a written Verification of Employment VOE. We have a loan program for every borrower.

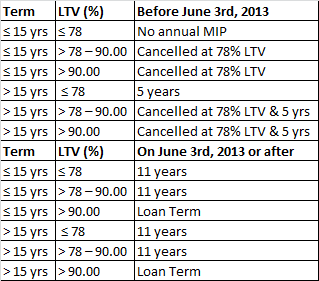

Ad Get fixed or adjustable rates on bare land choose the down payment thats right for you. All FHA loans will have upfront and monthly premiums except as noted. Ad Tired of Renting.

Lock Your Rate Before Rates Increase. Speak to a Loan Officer Today. If Approved Use What You Need.

Our unique position in working with a wide. I have applied for a mortgage loan and stated that I am now or was formerly employed by you. Minimum Fico of 620 and a down payment of 35 of the purchase price is needed.

The short answer is that FHA loan rules require the lender to verify at least two years of employment though not necessarily two years with the SAME employer. If Approved Access Funds To Help You Grow Your Business. Lower down payment requirements only 35 down.

Rural 1st offers a deep understanding of acreage and land loans. Now is the time to cash out. With the VOE loan program approval is much faster than through a conventional or FHA loan.

Ad Best FHA Loan Lenders Compared Rated. LTV 90 will be assessed at 11 years and at an LTV 90 MIP will apply for the duration of the loan term. FHA loans are an attractive option especially for first-time homeowners.

We eliminate the lengthy loan process we pre-approve our borrowers within hours. The new guidance regarding third-party verification of FHA borrower employment income and assets are outlined in Mortgagee Letter 2019-01. Alternative loan options also available.

If Approved Use What You Need.

Getting An Fha Loan Following Bankruptcy

True Lies When Employers Twist The Truth Freddie Mac Single Family

Non Prime Home Loans Credit Challenged Mortgage Bank Statement Income 1st Choice Mortgage

Simple Ways To Calculate The Finance Charge On A Mortgage Loan

Jumbo Loans California California Jumbo Mortgages

Voe Loans Voe Home Loans Mortgage Gcm Mortgage

Getting An Fha Loan Following Bankruptcy

Fha Loan Rules For Employment

Alternative Income Verification Loan Voe Loan Voe Mortgage Lenderline

Fha Loans California Fha Home Mortgage In Los Angeles Ca

Gmfs Mortgage 5 Star Residential Mortgage Lender Since 1999

![]()

Investor Cash Flow Loans Dclr Home Loan Lenders Gcm Mortgage

How Verification Of Employment Voe Works For Mortgage Lenders

Fha Loans Hg Mortgage

How To Complete A Verification Of Employment Voe For A Home Mortgage Loan Youtube

Mortgage Employment Verification A Guide Quicken Loans

Mortgage Loan Income Guidelines What You Need To Know